From Tulipomania to the "Dot-Com bubble", the tragic estimates of investors and economists have several times caused the disappearance of entire properties.

Cyprus has experienced many economic bubbles in its history, such as the stock market bubble, the developers bubble, the securities bubble and others.

"There are three great forces that move the world: nonsense, fear and greed," Albert Einstein once said.

Tulipomania

Tulips are a fatal flower in economic history. The appearance in Europe in the middle of the 16th century of the hitherto unknown flower caused a real fury, especially in the Netherlands, where the bulbs of rare varieties gained enormous value.

Amsterdam Stock Exchange has created special places for buying and selling tulips, something that other Dutch cities have imitated. Bulbs were bought and sold like stocks today on world stock exchanges. In fact, the price of a single tulip bulb is the same as that of a carriage, two horses or thousands of kilos of cheese.

Tulipomania persisted until February 1637, when the market collapsed due to doubts about the continuing rise in bulb prices. Panic gripped investors, everyone wanted to sell but no one wanted to buy. "Important traders have almost reached begging," wrote Charles Mackay, who has been extensively involved in the issue. Many saw their property disappear, and despite the Dutch government's investigation into the case, the country's economy has fallen into recession.

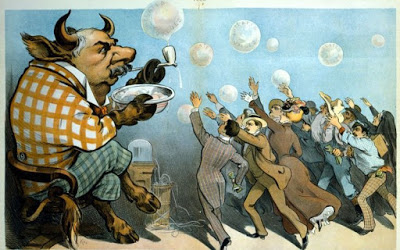

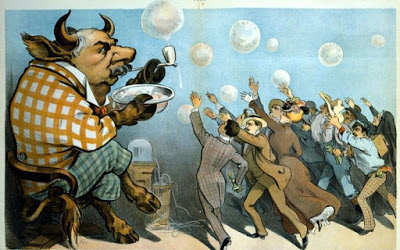

The bubble of the South Sea

The term "bubble" entered the dictionary in the early 18th century, when the British South Sea Company collapsed, drawing many investors with it. The company was founded in 1711, with its owners taking over part of Britain's debt in exchange for exclusive trade rights in South America.

Following the spread of rumors about the significant profits made by its activities, the company proceeded to issue shares to the public, which were taken by surprise. In a short time, their prices almost increased tenfold, but this bubble finally burst, leading to the financial disaster of thousands of investors. Subsequent investigations revealed bribery and widespread corruption, and several company executives ended up behind bars.

Mississippi's company

In 1716 France was faced with public debts and a lack of liquidity. The crisis was called for by Scotsman John Lowe, who proposed introducing the paper currency to revive the economy. With the support of the French government, Lowe set up a bank and began issuing banknotes that were supposed to be in gold and silver.

Shortly afterwards, he founded the Mississippi Company, which acquired a monopoly on the then French Louisiana, which was rumored to have gold reserves. Lowe began selling shares of the company, which piqued investors' interest, boosting their value. The information speaks of scenes of insanity on the streets of Paris, while it is said that women even sold their bodies to get money to buy shares.

The whole trick, which gave impetus to the French economy and made many people rich, will at some point stop performing. The Mississippi Company never found gold in Louisiana. When investors in 1920 wanted to redeem their banknotes in gold, they found that there were not enough stocks to meet their value. The company's stock prices plummeted dramatically and many wealthy people saw their profits disappear overnight. Lowe was forced to leave the country, fearing the wrath of deceived citizens.

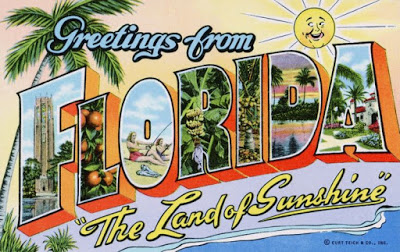

Real estate in Florida

Florida's reputation as a popular destination began to develop after the end of World War I, when the prosperity of many Americans led them to the sunny state in search of a cheap home. The reckless buying and selling of land gave and took, with prices doubling every few months during 1920. In some cases, "investors" did not even have the capital to buy, they just gave the advance, resold the land profitably and then they paid the remaining amount.

And while it seemed that the boom in the housing market in the region knew no bounds, in early 1926, buyers stopped appearing to buy into these overvalued values. The panic did not take long to appear, with investors selling to secure their profits but with huge losses.

The Great Crash

The 1920s were a time of euphoria for the US stock market. It was the time when many households in the United States discovered the stock market, took out loans, which they invested in the hope of getting rich.

In the autumn of 1929, stock prices had risen unrealistically. Although there have been rumors of their impending decline, many prominent economists have argued otherwise. Optimism finally waned on October 24, when about 13 million shares were sold by panicked investors. "Black Thursday" was followed by "Black Tuesday", when the stock market collapsed even more, causing chaos and hastening the Great Depression that had been hovering over the United States for almost a decade.

The "Dot-Com bubble"

Few bubbles can compare to those of the 1990s. The Internet and new technologies have caused a huge wave of euphoria among investors interested in financing new companies. The compound NASDAQ index, which contains mostly technology stocks, jumped from 500 points in April 1991 to more than 5.000 points in March 2000.

Excessive mania led people to invest "blindly" in anything that was simply connected to the new industry. When they finally realize that this is a classic speculative bubble, the NASDAQ index will plummet in 2002, disappearing billions of dollars from investors' portfolios.

The US housing bubble

Many experts believe that the above "technological bubble", as it has also been described, has led investors to real estate, believing that it is a much safer sector. Real estate prices in the United States began to rise sharply in the late 1990s and early 2000s. without the banks having full collateral.

That same year, the downturn will begin and the bubble will inevitably burst, leading to a crisis of high-risk mortgages, where many borrowers have found themselves in a difficult position to meet the demands of repaying their loans. The crisis in the global economy in 2008 is estimated to be largely due to the bursting of this last bubble.

Source: Newsbeast.gr