At 4.30 am on 6 January 2009, a night shift in Agropolychim, Bulgaria's largest fertilizer plant, received a fax warning that the gas supply would be cut off immediately. The factory's engineers demanded a four-hour extension: an immediate shutdown of the unit would allow a cocktail of explosive chemicals to thicken in the pipes, destroying vital equipment. "Everything was exposed," recalls Agropolychim CEO Philip Robo.

Bulgaria was one of the countries hardest hit when Russia cut off gas supplies to Europe during that harsh winter. Within an hour the stores sold out all the stock from electric heaters they had. People in many parts of the Balkans had to return to burning wood to keep warm. At the Sofia Zoo, officials were able to keep African monkeys on tour alive by providing them with buckets of hot herbal tea mixed with lemon and honey.

Today, Bulgaria again looks extremely vulnerable in the event that developments in Ukraine lead to a new energy collapse.

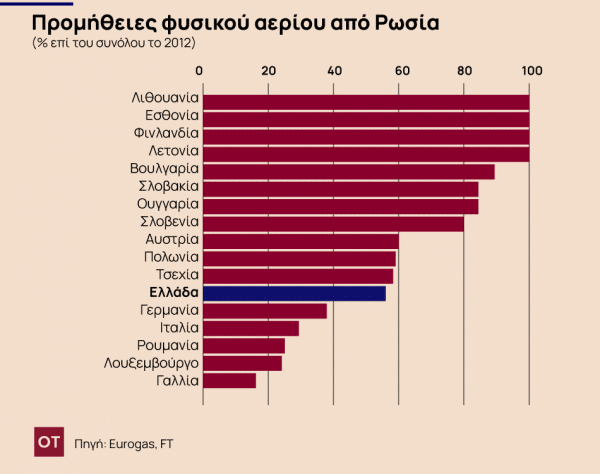

Signs from Russia's gas cuts in 2006 and 2009 are sweeping deep into Eastern Europe. At first glance, the whole continent seems to be in danger again this year due to a seemingly unshakable dependence on Gazprom, Moscow's gas export monopoly. Europe's imports from Russia rose 16% last year to a record high. In total, Gazprom supplies 30% of Europe's gas. But, in many eastern states the dependency reaches 100%.

Half of Europe's Russian gas imports are made through Ukraine, and this supply remains a potential hostage to politics. Last June, Gazprom cut off gas sales to Kyiv over a pricing dispute, raising fears that Ukraine would be forced to block gas flows to Europe if its own supplies were not restored in the winter. Moscow is also tightening its grip on Kyiv, preventing EU countries from re-exporting Russian gas to Ukraine - the so-called "reverse flows".

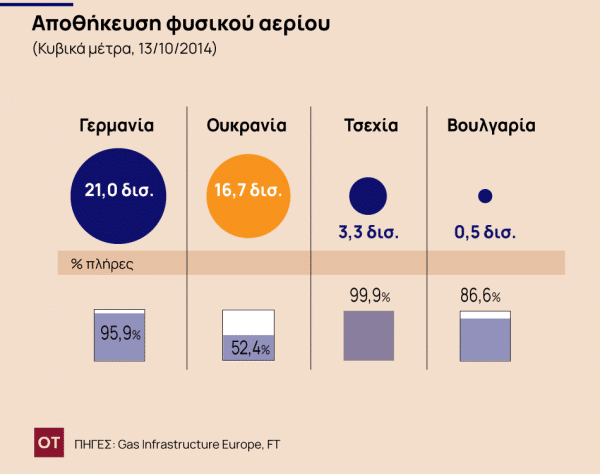

Diplomats are increasingly hoping that in talks next week in Berlin, the EU, Russia and Ukraine will reach an agreement on the resumption of gas supplies to Kyiv. But even if there is an agreement, most Eastern European governments can hardly relax. "Our main concern has nothing to do with the transport of natural gas through the territory of Ukraine," said Vaclav Bartuska, the Czech government's energy official.

The EU's first line of defense is its much higher gas reserves today than it was in 2009. The tanks are now 93% full, giving most countries a safety cushion of several weeks or even months if Russia cuts them. supplies. Hungary, for example, increased the volume of underground gas storage facilities to 6,2 billion cubic meters after the previous crisis to ensure its annual consumption, which reaches 10,2 billion cubic meters. The Hungarian available is currently 4,2 billion cubic meters. The Czech Republic has at its disposal 3,3 billion cubic meters of natural gas, a quantity that provides it with a security as its annual consumption reaches 7,5 billion cubic meters.

With oil prices falling below $ 90 a barrel, the EU is increasingly convinced that the Moscow Finance Ministry does not want any reduction in gas sales, nor does it risk a possible historic shift of more European customers from gas. in other fuels. "They realize that they too would get into trouble. "In addition, Russia has an interest in being considered a reliable supplier," said Karel De Gacht, a former EU trade commissioner.

However, it may be too late for the Russians to stop the gradual but systematic withdrawal of Europeans from Gazprom, which is in progress. Mr. Robo's drawings in Agropolychim show that Moscow does not have all the papers in its hands. Next year the Bulgarian plant will switch from natural gas to biomass and will operate on straw and crushed wood. This is very important for Gazprom, because Agropolychim and Neochim, Bulgaria's top fertilizer plants, together consume about 25% of the country's gas.

The story is similar in Poland, where Grupa Azoty, the country's largest consumer of natural gas, seeks to break its dependence on Russia. Grupa Azoty, also a fertilizer group, consumes 15% of Poland's annual gas imports. But it has promised that by 2026, half of the 2,3 billion cubic meters it consumes will be sourced from non-Russian sources. "I firmly believe that we will be able to achieve this," said Pavel Jarkzewski, CEO.

Mr Jarzkevsky bases his belief in part on the deep structural changes taking place in the EU, described as "energy union". EU countries are building key infrastructure - such as liquefied natural gas terminals and cross-border pipelines - to break the dependent dependence on Russian supply routes. However, progress on the whole project is anxiously slow. Fitch does not expect Europe to reduce its energy dependence on Russia "before the next decade, possibly much later."

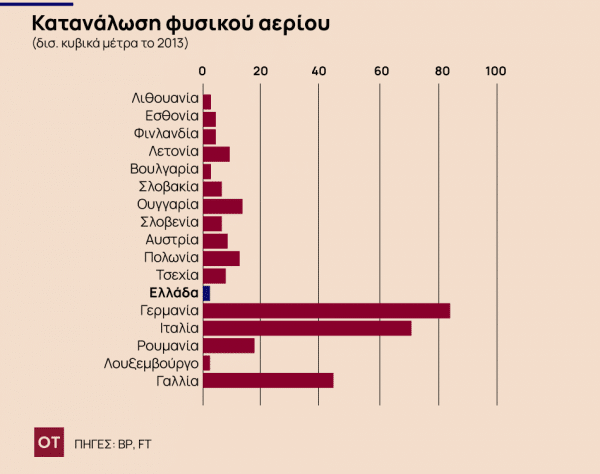

The major western EU countries are at lower risk because they already have greater supply diversity and also large liquefied natural gas (LNG) import ports, through which gas is supplied from Norway, Algeria and beyond. Germany has the Nord Stream pipeline through which it imports gas directly from Russia. This pipeline is considered unlikely to be trapped because it does not pass through Ukraine. The country that is considered the most energy vulnerable is Italy, which would face problems if riots broke out in both Russia and Libya at the same time.

Grupa Azoty is likely to take advantage of an LNG terminal in Svinusici on the Polish Baltic coast, which opens next year. The Baltic will also be served by a terminal in Klaipeda, Lithuania, which will start operating in 2015.

"A pipeline connecting the terminal and the (Azoty subsidiary) Zaklady Chemiczne Police will allow us to take advantage of additional flows of non-Russian gas from the Persian Gulf or shale oil flows from the United States," said Yarkzef. The US is discussing whether to send supplies to Poland. This is not going to happen if Washington does not lift the general restrictions it has adopted on gas exports from the country.

Agropolychim and Grupa Azoty also say they are moving away from Russia because of high prices set by Gazprom as a guarantee of supply. Gazprom could not be reached for comment.

Mr Robo says he is leaving Russia for financial reasons. Because Russian prices are much higher than those found at European hubs, such as in Zeebrugge, Belgium, where gas is traded on an open market. "I am a businessman. . . this has to do with the economy. "If I achieved the same price [for gas] as biomass, I would not be oriented towards biomass," he explains.

Bulgaria's energy analyst and former ambassador to Moscow, Ilyan Vasilev, says Russia's high prices are crippling the competitiveness of Central European industries in areas such as chemicals and metallurgy, but also make central heating expensive. "Few, if any, survive."

In fact, says Vassilev, Gazprom is exterminating its customers, accelerating deindustrialisation at the high prices it is asking for. Imports of Russian gas from Bulgaria fell to 2,7 billion cubic meters last year from 6,7 billion cubic meters in 1989, the last year of communist rule.

The Bulgarian analyst argues that any decision by Russia to reduce gas will depend on political factors in Moscow. "President Vladimir Putin's irrationality has its limits, and these limits are set first by the sense of what it takes to survive and second by how much it's in the hands of the oligarchs," he said.

Russia would be willing to avoid any shock that would push the EU to adopt other fuels, Vassilev added. "I do not expect that even if the gas supply is cut off, it will take a long time. "Because Moscow knows that such a move will trigger radical tendencies of differentiation in the EU that it will not be able to control."

In Prague, Bartuska also warned that Mr Putin would likely find that there was no going back: "Changing fuel is not an easy task. It will be costly and will take some time. "But once that happens, many customers will not return to gas even if the gas industry as a whole falls to its knees to beg."

Source: Financial Postman