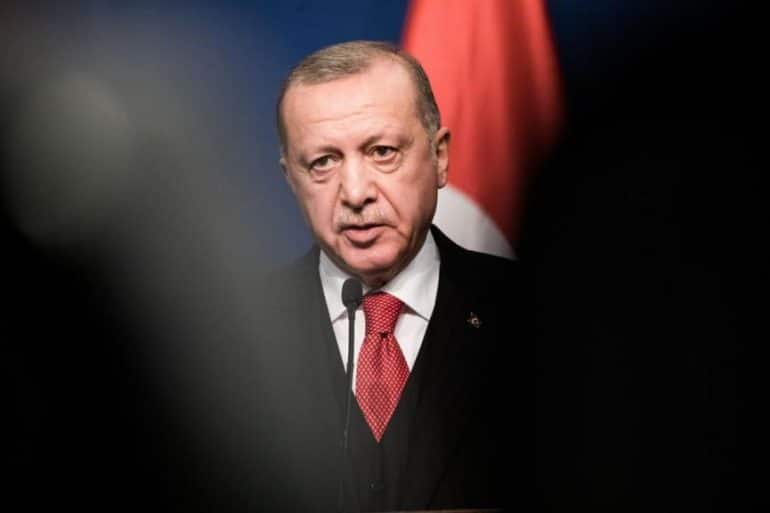

Whenever Turkish President Recep Tayyip Erdogan refers to his peculiar economic theory that lower interest rates lead to stimulated economic growth and job creation, the pound hits historically low against the dollar.

Turkey has long since moved away from the "old" policy that we should rely on high borrowing costs and a strong currency to slow inflation, and instead has chosen to prioritize large investments, exports and strong job creation, Erdogan said on Monday.

As he said after the cabinet meeting in Ankara, "Our choice was either to abandon investment, growth and job creation, or to take on the historic challenge and meet our own priorities."

Although most central banks are opting to tighten their policies as the global recovery sparks rising prices, Turkey's decision to cut lending rates by 4 percentage points since September has upset markets and worried investors who support it. that the country's monetary policy is becoming increasingly volatile and unpredictable.

The president firmly supports the unorthodox (financial) view that high borrowing costs are causing inflation rather than restraining it, and "urges" the central bank to cut interest rates sharply, despite inflation hovering close to 20%.

Erdogan's "urge" to the central bank to double the recent cut in interest rates led the pound to fall again after the Turkish stock market closed. The Turkish currency fell as much as 2,1% to $ 11,4767 and then reduced its losses to 0,9% and $ 11,3804.

SOURCE: Bloomberg / newmoney.gr