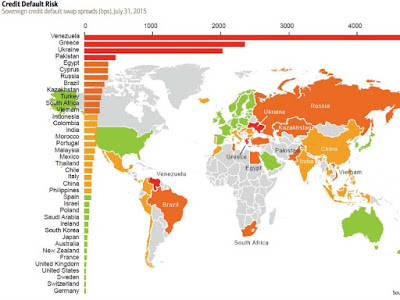

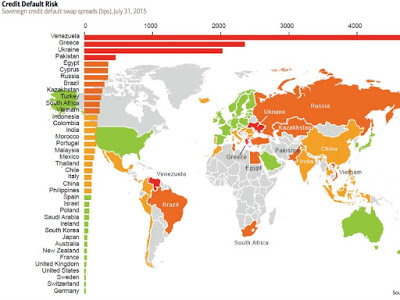

Specifically, Cyprus is presented as occupying the 6th place among 39 ranking positions where the countries with the highest economic risks are clearly distinguished.

In fact, it is marginally the second country after Egypt in the orange zone with about 500 basis points in the Bank's measurement scale.

The map uses the prices of CDS (insurance premiums against bankruptcy risk), which are essentially derivatives that compensate in case of inability to repay debts - in case it also leads to the debtor's bankruptcy.

As with any insurance product, the more expensive it is, the more likely it is that the risk of wanting to be insured is more likely to occur soon.

Venezuela holds the negative lead and even far behind the second.

With 5,000 base units, it flirts with the ultimate zenith of the ladder and is arguably the most dangerous country in terms of national debt!

With about half of the base units, 2,300 specifically, Greece ranks second on that list, while Ukraine completes the trio with about 2000 base units.

Pakistan and Egypt are in the top five in terms of dangerous performance.

Of particular interest, however, are the positions in which Spain and Ireland are ranked. Although both countries have gone through and are going through the ordeals of the economic crisis, it is recognized that they have made great progress, including their entry into the safe zone.

They even have lower CDS than Italy and Portugal.

In the green, and in fact the safest country in terms of debt is Germany with almost zero percent.

Switzerland, as well as Sweden, complete everything but a precarious trinity.

Source: SigmaLive